If your credit history is not good and you are finding it difficult to open a bank account because of this, then don’t worry as there are bank accounts you can open that don’t require a credit check.

You will be able to carry out your everyday transactions including purchasing online and in stores, setting up direct debit payments, use at ATM machines and having your pay from work deposited in the account.

Bank accounts that do not require credit checks

Here are some banks accounts that do not require a credit check.

1. Cashplus Bank

| Pros | Get Account |

|---|---|

* Open an account in 4 minutes, online or on an app. * Contactless card. * No monthly fees, easy to use. * Set up standing orders and direct debits. * Deposit money at any UK Post Office. | Get account |

| Cons | |

| * Monthly fee £5.95. * 0.3% charge for depositing at Post Office, or minimum £2. * ATM withdrawals fee £2.00. | Get account |

Cashplus Bank, also has FSCS protection, so you have protection from the UK government. They also have UK based call centres.

Go to Cashplus Bank, here: Cashplus Bank Account.

2. Pockit

| Pros | Get Account |

|---|---|

* Open an account in 3 minutes, online or on an app. * Contactless card. * Get up to £20 a month cashback. * Set up standing orders and direct debits. * Deposit money at 28, 000 PayPoint stores. | Get account |

| Cons | |

| * Monthly fee £1.99. * Deposit money in PayPoint stores for £1.49 per deposit. * ATM withdrawals fee £0.99. | Get account |

With Pockit, you get real time notifications of your spending and balance updates. You can also freeze and unfreeze your card for free.

Go to Pockit, here: Pockit Bank Account.

3. Card One Money

| Pros | Get Account |

|---|---|

* They will deliver your sort code and account number by text, usually within minutes. * Contactless card. * Allocate funds – set aside funds for bills or outgoing payments. * Up to 3.5% cashback in some stores. * Deposit money into your account by cash or cheques at a Post Office. | Get account |

| Cons | |

| * Monthly fee £12.50. * Maximum card balance £5, 000. * ATM withdrawals fee £1.50. |

With Card One Money, you can set up direct debit and standing orders to pay your bills.

Go to Card One Money, here: Card One Money.

4. Suits Me

| Pros | Get Account |

|---|---|

* Get instant access to a UK account in just 10 minutes. * Contactless card. * Allocate funds – set aside funds for bills or outgoing payments. * Get exclusive cashback, rewards and deals from partners. * Receive and send money and make international transfers. | Get account |

| Cons | Get account |

| * Monthly fee £4.97. * Maximum card balance £5, 000. * ATM withdrawals fee £1.25. |

Suites Me has a multi-lingual customer service team. You can deposit money at any PayPoint store for 0.99p + 2.6%.

Go to Suites Me, here: Suits Me Card.

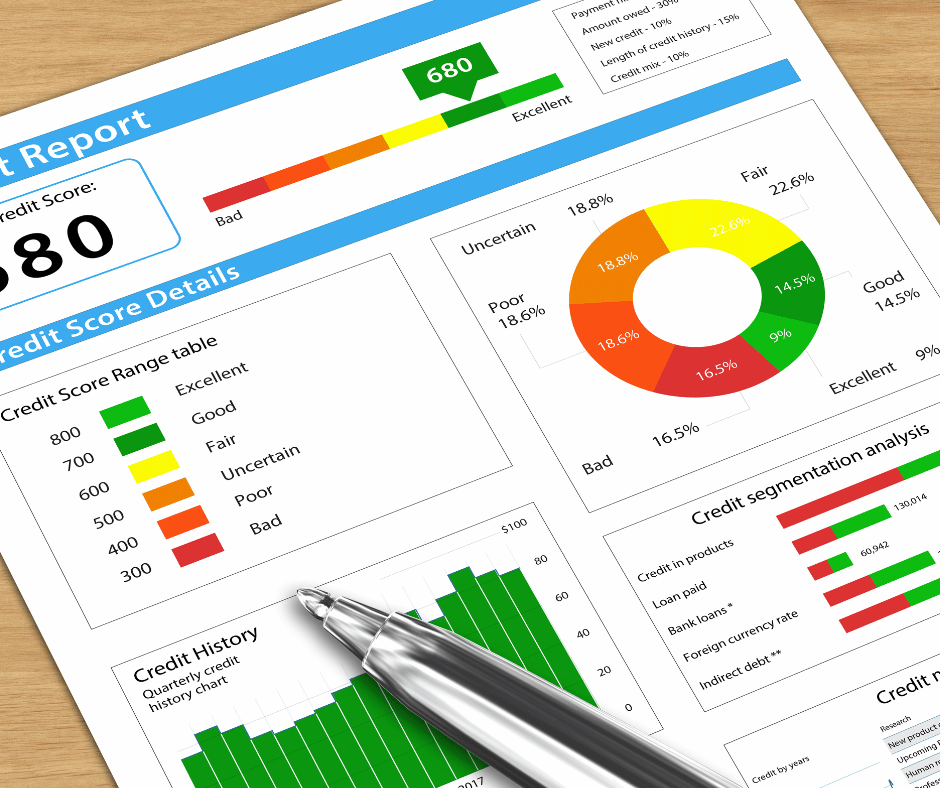

Build Credit Score

If you have a bad credit score, having any of these accounts could help towards improving your credit score.

Building up credit scores involves being able to manage your money, including paying bills to schedule.

If you are in debt and making payments for this, then it is important that you maintain this to clear your debt. If you need support with this, then you can get help and advice from your local Citizens Advice or from the National Debtline.

Basic Accounts

If you have a bad credit history, you might still be able to get a basic account from your local bank, building society or Credit Union.

They would be free accounts, where you will not be paying any monthly charges.

Additional information

If you are looking for the best SIM only deal, read out article: Best SIM Only Deals UK – best SIM only plans available

If you are looking for home insurance, read our article: Home Insurance – Compare Cheap Quotes.

If you are looking for a web domain, check out Google Domain, here: Google Domain.

If you are looking for advertise on the web, check out Google Ads, here: Google Ads.

Money Advice Service

For debt management and advice on how to pay for bills go here: Money Advice Service info page.

If you would like to know how to improve your credit score, go to: Money Helper.

If you would like free advice on debt, go to: Citizens Advice.