What is a basic bank account?

If you are unable to open a regular account with a bank or building society because you have bad credit score or low income, then you can open a basic account.

The government has requested that the top banks and building societies offer basic accounts to people who are unable to obtain a regular bank or building society account, so they are able to have an account to receive wages, benefits and make payments.

However, even though many banks and building societies have stated they will offer a basic account to people, many do not publicise it. If you cannot see it written or publicised anywhere, you have to ask them for it.

Can I open a basic bank account?

Yes, if you live in the UK and have the relevant proof of ID, then you should be able to open a basic bank account. This is the agreement the government has requested from UK’s top banks and building societies.

What do you get with a basic bank account?

- A debit card so you can make payments

- You do not get charged a fee on failed payments

- No overdraft facilities

- You can only spend if you have the money in your account

- They should let you set up standing orders and direct debit payments

- Access to online banking, as well as over the telephone

- Access to withdraw money from ATMs

- You can deposit your money at the bank / building society or Post Office

Basic bank accounts

Here are some basic accounts from banks and building societies:

Alternative options for bank accounts

If you are still having difficulties opening a basic bank account. Here are alternative accounts you can open. These are online, card accounts and app accounts. You can also use these accounts for business and self-employed business as well. They might give more facilities than a basic bank account. You can open these as an extra account, to get additional benefits:

Documents required for ID to open a basic account

Here are few example of documents you can use for ID:

- UK Passport, Biometric Residence Permit, Foreign Passport and Visa

- EU and EEA National Identity Card

- UK Driving Licence / EU EEA Driving Licence

- Benefits Entitlement Letter (Recent, or up to 12 months)

- Home Office Immigration Status Document / Application Card

- Student ID (for student account)

- Travel Documents Issued By The UK Government

Documents required as proof of address

Here are some documents which can be used as proof of address:

- Letter from Council

- Gas and Electric Bill

- Bank Statement / Credit Card Statement

- Driving Licence

- Mortgage Statement

- Benefit Statement, such as Universal Credit (dated within 12 months)

- HMRC Tax Notification (dated within 12 months)

- UK Credit Union Statement (dated with 12 months)

- Phone Bill

- Satellite or Cable Bill

- Internet Bill

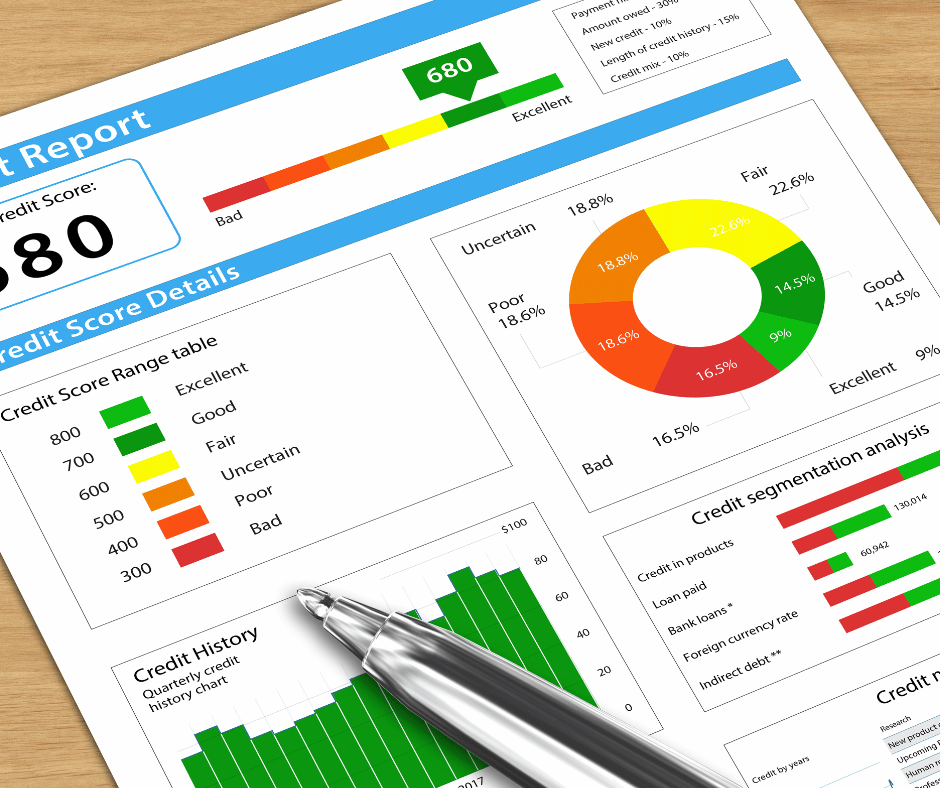

Improving your credit score

If you do not have a good credit score, by having a basic account or account such as Cashplus, Card One Money, Pockit, Suites Me or Revolut will help to improve your credit ratings. You might then be able to get more banking facilities and open a regular bank or building society account.

Credit Unions

Credit Unions are set up by members for members, and they offer bank accounts and loans. You can get a bank account from a Credit Union. Find your local credit union, here: Find Your Credit Union.

Additional information

If you would like help with your energy bills, read our article: Help With Energy Bills.

To find out more about credit unions or advice on debt, go to Money Helper: Money Helper.

If you are looking for a home insurance, read our article: Home Insurance – Compare Cheap Quotes.

If you are looking for the best SIM only deal, read out article: Best SIM Only Deals UK – best SIM only plans available

If you are interested, check out: Best Bank Accounts for Bad Credit.

If you are interested in a loan, check out: Loan.co.uk.

If you would like more information about bank regulations, go to: Financial Conduct Authority (FCA).

Pingback: Top 10 Online Bank Accounts - Best Online Banks UK

Pingback: Cheapest Places to Live With Great Employment Opportunities in UK