This is a quick review of Monzo Flex.

Monzo Flex: Buy now pay later credit card

Monzo Flex is a credit card from Monzo Bank that lets you buy something now and pay for it later. Monzo Bank is an app based challenger bank that has become popular in the UK and has thousands of customers.

It was set up in 2017 to provide an alternative form of banking for people. Monzo is a proper bank that is FSCS protected.

Go to Monzo Flex, here: Monzo Flex.

What is Monzo Flex and how does it work?

Monzo Flex is a credit card that allows you to pay for your purchase in 3 monthly payments without paying any interest. It provides a buy now pay later facility.

However, unlike some buy now pay later providers, you are not limited to certain places to shop depending on the partnerships they have. With Monzo Flex, you can shop in any store or online.

If you did not want to finish paying for your purchase the within 3 monthly payments, then you have the option of paying back for your purchase with 6 and 12 monthly payments at 29% APR representative (Variable).

Is my purchase protected?

If eligible, items purchased with Monzo Flex are protected. It has the Section 75 protection on eligible purchases that you make with your virtual card, just like it is with a credit card.

It’s good to know that you have the same protection as a credit card on eligible purchases.

Award winning credit card

As on the Monzo site, the Monzo Credit Card was awarded ‘credit card of the year 2023’. The Monzo Credit card has no hidden fees and has a credit limit of up to £3,000. You are able to turn almost any purchase in to a buy now and pay later monthly payment.

So if you need a new laptop or some clothes you are able to buy them now and pay for them later.

Flexibility to pay

You can pay by Monzo Flex from the go or if you want you can transfer purchases from your Monzo Current account to Monzo Flex with a simple click, as long as it is within 2 week of purchase.

So if you have bought something using your Monzo Current Account and you think it will be easier for you to pay with Monzo Flex, you are able to move your purchase to Monzo Flex.

If you don’t make a payment, Monzo does not charge you. It will give you up to 7 days to make your payment. If you still have not made a payment, then if you were on a 3 months or a 6 months payment, it will move you to 12 months payment.

You also have the freedom to pay an extra amount or pay back quicker so you save yourself from paying some interest. And, all your payments can be managed through the Monzo app.

Use abroad with no extra fees

A good thing about the Flex card is that you can use it in the UK or abroad in any currency. And, it is fee-free. This means that Monzo do not add any mark-up on the Mastercard’s exchange rate.

This could save you money. If you were abroad and you exchanged your pounds into the local currency, you might pay a fee to have your pounds exchanged.

Non payments

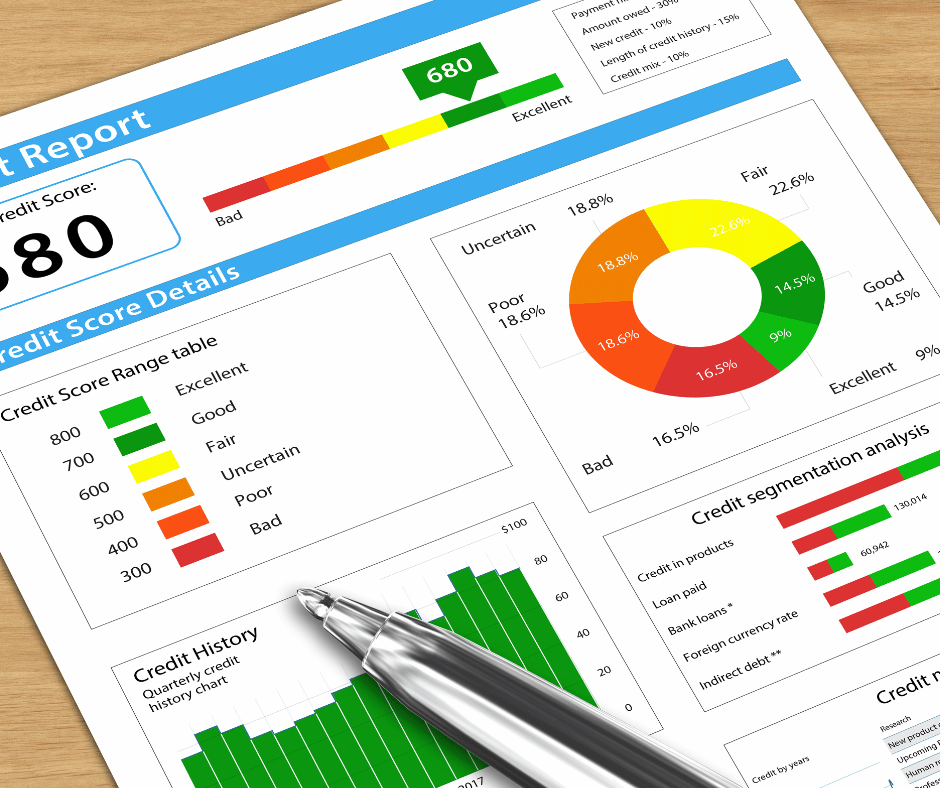

Before you take out a purchase with the Monzo Flex card, consider if you are able to keep up the payments. If you do not keep up with payments then it could affect your Credit Rating.

Any unpaid debt could also be moved over to a debt collecting company.

Comment

The Monzo Flex Card provides you with the facility to buy now and pay later. It is different from some buy now and pay later providers as you are not restricted to certain stores where you can purchase items from.

You can also use it abroad without any additional mark-up on the Mastercard exchange rate being made by Monzo.

You can also manage all your transactions via the Monzo app.

Go to Monzo Flex, here: Monzo Flex.

Additional Information

Money Advice Service

For debt management and advice on how to pay for bills go here: Money Advice Service info page.